Take a self-guided tour of the platform.

Explore the latest spend insights

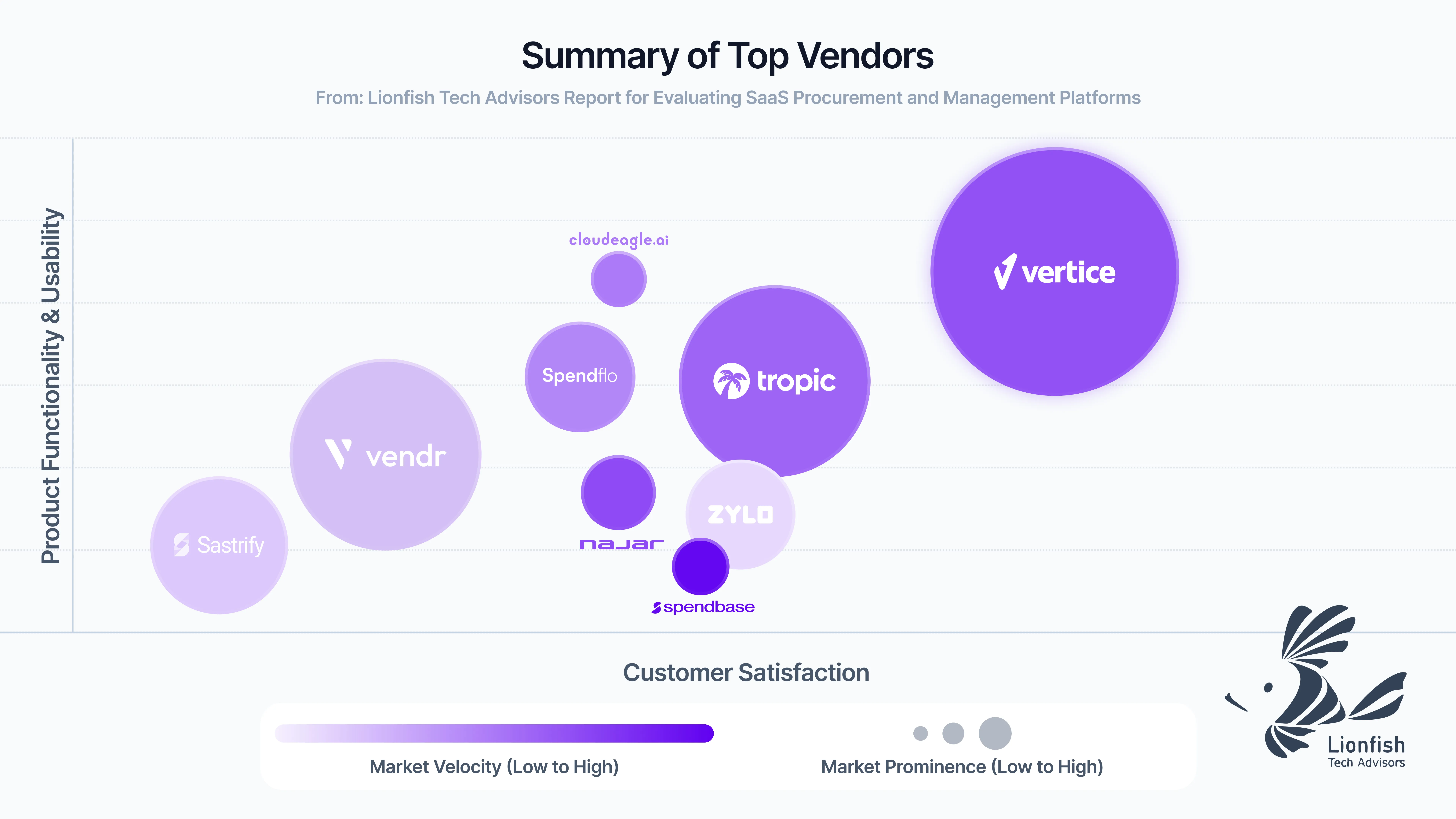

See why Vertice is trusted by top procurement leaders.

Unlock exclusive benchmarks and real-time trends shaping SaaS, cloud and procurement spending.

To say that the last few years have been tough on businesses would well and truly be an understatement. A combination of macroeconomic and geopolitical events wreaked havoc on organizations in every corner of the globe, driving more and more companies into survival mode.

But with the need to survive comes the need to adapt.

For many, this involves focusing on one of the fastest growing expense categories and the third largest item behind payroll and cloud costs – software.

The question is: what impact is this likely to have on the industry? And what else can we expect to see going forward?

Here are our predictions.

SaaS trends and predictions

Shadow AI will pose a greater challenge

With AI tools now accounting for a greater chunk of total software spend within the average organization – up from 1% to 3% in the space of just six months – these applications are certainly making their mark.

But it’s not just the financial impact that companies need to be mindful of. And it’s not just the approved tools that have made their way through official procurement channels.

As more AI solutions come to market – data indicates there are over 11,000 tools now available worldwide – the risk of shadow AI rises. By this, we mean that a greater number of tools will likely be acquired by employees, unbeknown to the IT, finance and procurement departments.In fact, given the infancy and relative affordability of many of these AI tools, there’s the very real chance that this type of software could become a bigger culprit of maverick spending than any other type of SaaS application.

But with a greater focus on compliance and organizational spend, it’s also likely that we’ll see companies start to become more considerate of how AI is being used internally, and more aware of the associated risks.

According to Nick Riley, Vertice’s Head of Global Buying, we’re already starting to notice new players emerge that tackle this type of problem head on.

“We’re seeing more tools that aren’t necessarily providing generative AI themselves, but that are helping companies discover who within their organization is using AI and monitoring how and when they’re using it. For example, using real-time detection to see if they’re putting stuff in there that is sensitive or providing personally identifiable information (PII). Lasso is one example of a vendor that’s jumped on the bandwagon of AI, but in a way that focuses on solving the problems that AI brings.”

The end of the “software price hike”?

Over the past two years, we’ve witnessed opportunistic vendors hike their prices far beyond general inflation. Prices in 2023, for example, rose by an average of 12%, whereas market inflation dropped to 5.2% globally.

The question is: with CPI inflation now slowing, will 2024 be the turning point for more modest increases?We believe so.

But even if our prediction is correct and price increases become less ‘extreme’, businesses shouldn’t rest on their laurels when it comes to the cost of their software solutions. Many vendors will undoubtedly look for ways to make gains through less obvious methods, for example by reducing the discounts they offer or by restructuring their pricing models, providing customers with less value for money.

Understanding these subtle tactics that vendors may apply to up your spend is therefore crucial for tackling ‘SaaS shrinkflation’ head on.

A shift from a “growth-at-all-costs” mindset to an efficient growth mindset

The knock-on effect of countless macroeconomic events has well and truly put an end to frivolous spending within most organizations. Gone are the days where companies could easily raise capital, meaning they are having to shift their focus towards reducing overhead and increasing efficiency.

In other words, doing more with less.

And as Joyce Mackenzie Liu, Founder and CEO of Pegafund explains, “I think a lot of what is happening on a macroeconomic and geopolitical level, for example the wars happening across the world and the Silicon Valley Bank failing of 2023, have resulted in much heavier emphasis on liquidity and cash management, and essentially how you can better leverage the balance sheet”.

For many, this involves cutting back on the biggest line items such as cloud spend, employee headcount and SaaS fees.

But while the impact of cost-cutting is already being felt across the software industry in particular, Nick anticipates that it will get even worse this year. “New business sales have unsurprisingly dropped. In Q4 of 2022, around 20% of all the purchases we processed were for new purchases. In Q4 of 2023, this was down to around 12%, and we’re projecting it to be as low as 8% in 2024.”

Rather than purchasing new tools on a whim, we expect to see companies become far more mindful of the tools they’re choosing to procure and far less wasteful of the tools they’re already using. After all, with as many as 66% of software licenses going unused or underutilized within the average organization, equating to upwards of $1.6 million for companies with more than 500 employees, companies will have no choice but to start taking this problem seriously.

66% of software licenses go unused or underutilized within the average organization, equating to upwards of $1.6 million for companies with more than 500 employees.

As such, we anticipate there will be a greater focus on the evaluation of tech, with finance leaders looking to rationalize their software stacks, for instance by consolidating tools, renegotiating terms and even canceling unwanted tools. This will, however, require a solid understanding of how their current applications are being utilized across the business, along with intel into what other companies are actually paying for the same tools.

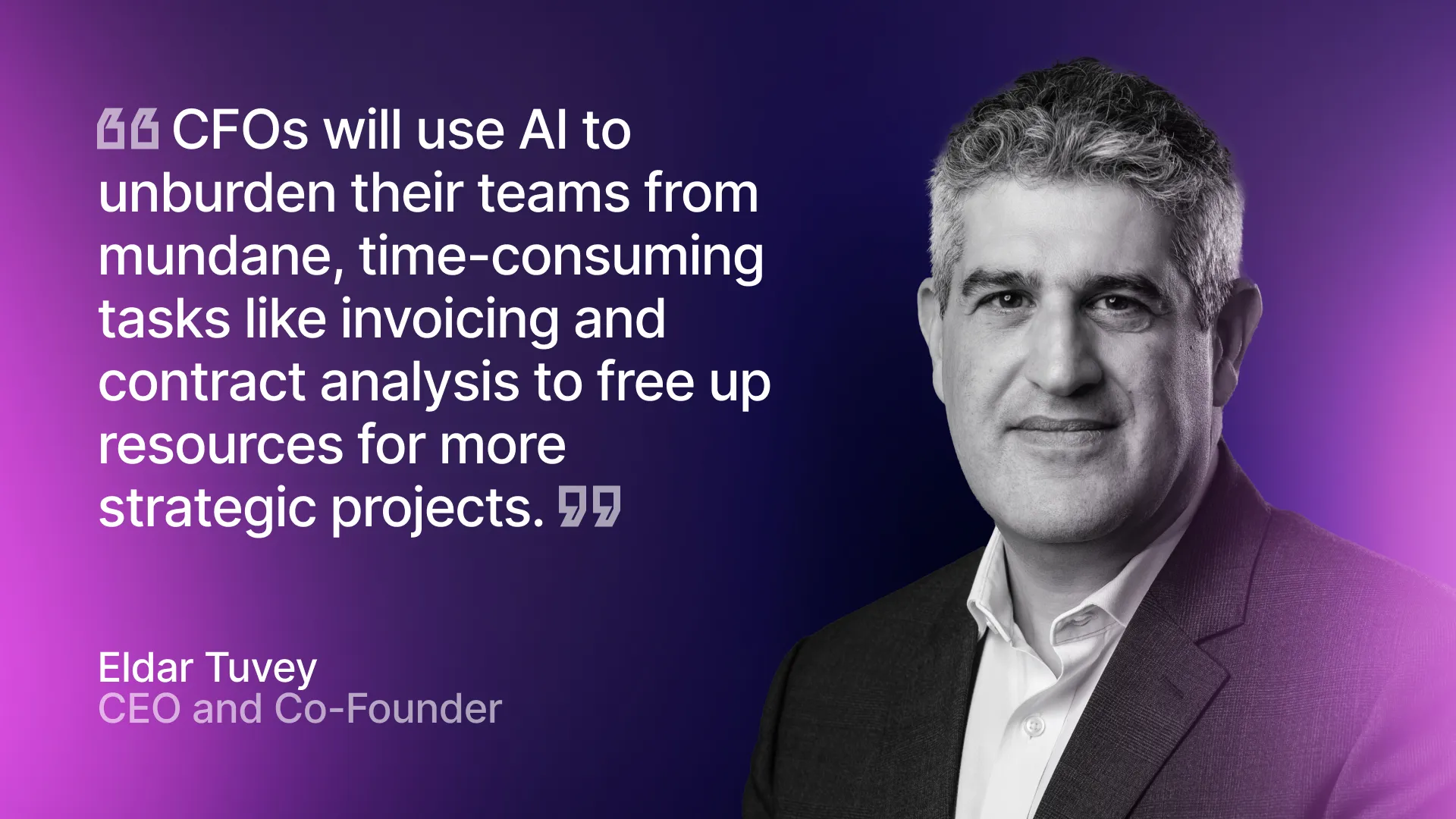

Finance teams will increasingly turn to AI to maximize efficiencies

With efficiency measures becoming all the more important, it comes as little surprise that automation is high on the list for finance executives, as teams look for ways to unburden themselves from manual, time-consuming tasks, in order to focus on more strategic projects.

According to Vertice’s CEO, Eldar Tuvey, “I expect to see faster adoption of AI software among CFOs seeking efficiencies on everything from budgeting and invoicing, to analyzing contracts at speed”.

Pegafund’s CEO, Joyce Mackenzie Liu, believes it’s still early days in terms of how companies are using these tools to maximize efficiency in business. “We haven’t really seen AI being meaningfully monetized in business yet, for example by increasing the propensity to price a solution or upselling expansion opportunities, but I’m pretty excited to see what will happen in 2024 and beyond from that perspective.

”The pressure to keep up with new software will, however, present a budgeting challenge for the modern CFO, who will need to devote more scrutiny and attention on software purchasing in general to keep tight control of spending. This means that legacy products will increasingly be under the spotlight as new players emerge, with companies less willing to stay loyal to the big software players if they can’t keep up with the AI arms race."

How Vertice can help you become more cost efficient

In recent years, both SaaS and cloud computing have become two of the largest outgoings in any modern organization. Yet, with the cost of both rising exponentially year-on-year – by 12% and 35% respectively – they have fast become areas of spending that finance leaders are scrambling to get under control.

The problem is, they’re also areas of spending that many have limited visibility of.At least without a tool such as Vertice, that is.See for yourself how our integrated SaaS and cloud cost management platform can help you get a better handle on your organization’s spend and usage. Alternatively, read how one company was able to save as much as $155,000 on a single SaaS contract.

.webp)

.webp)