SaaS Shrinkflation: From chocolate bars to software

Take a self-guided tour of the platform.

See why Vertice is trusted by top procurement leaders.

Ask the average Brit what comes to mind when they hear the term inflation and there’s a high chance you’ll get the response ‘Freddo’.

For a very long time, the iconic chocolate frog cost just 10p, a price that has since more than tripled to 35p. And it’s not a price increase that’s gone down lightly – the national outrage has meant that these chocolate bars are now used by many as an unofficial measure of inflation.

But while in the UK we can at least take comfort from the fact that Cadbury hasn’t reduced the size, the same can’t be said across the globe.

In Australia, the size of a Freddo bar shrunk from an already meager 18g to just 12g, leaving the company facing accusations of “shrinkflation” – the tactic of reducing the size of a product and either keeping the price the same or increasing it. In this case, the latter.

And it’s not just Cadbury that is shrinking the size of its chocolate. It’s rife across the industry, with everyone from Mars Wrigley to Hershey’s doing it – bags of Maltesers have reduced from 189g to 175g, Galaxy bars weigh 10% less and Hershey’s Kisses are now a couple of ounces smaller than before.

But despite the term being coined for consumer goods, the concept has also made its way into the business world.

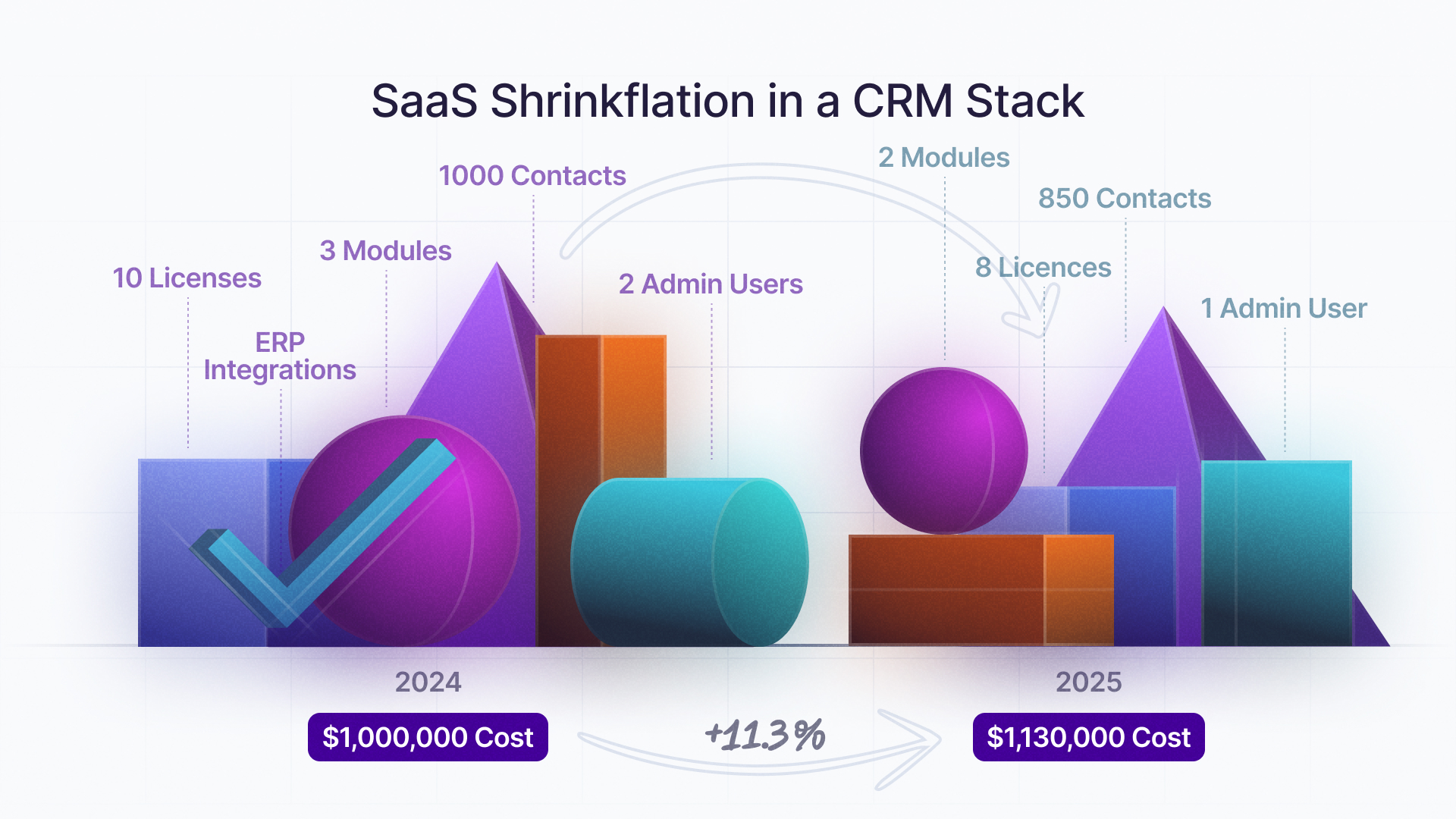

We’re now seeing numerous SaaS companies implementing subtle tactics to increase revenue without making obvious increases to their pricing.

What software companies are learning from chocolate manufacturers

It’s no secret that SaaS prices are on the rise – not a month goes by without numerous software providers announcing imminent changes to their pricing models.

As frustrating as these price hikes may be, they are, for the most part, clearly articulated by the vendors.

What many SaaS buyers aren’t aware of, however, is that it’s not just these obvious price increases that are bumping up the cost of your overall bill. It’s also the impact of SaaS shrinkflation. Something that’s not quite as easy to detect.

While you can visualize how a packet of Maltesers may have decreased in size over the years, it’s not as clear cut when it comes to a non-physical commodity such as software.

But it’s happening. The question is, how?

Here’s a few examples of how the software world is adopting shrinkflation tactics:

Examples of SaaS shrinkflation

Feature bundling

The concept of bundling features into a single offering may not be new, but it’s a tactic that more and more software providers are starting to adopt in a bid to boost revenue.

While it can be easy to presume that more features means greater value, this isn’t always the case. This is because buyers are left with no choice but to subscribe to a plan that consists of functionality they have no use for – at a higher cost than they would otherwise need to pay if they were only charged for the features they actually needed.

Feature unbundling

Feature unbundling is yet another example of how SaaS shrinkflation is driving up spend and is the exact opposite tactic of bundling. Where a company may have previously had ten features as part of their plan, we’re now seeing vendors effectively unbundle these features at the point of renewal and include each one as an individual line item at a fixed cost.

In fact, we’re seeing this happen a lot with enterprise-level renewals, as these plan types are often obscured on the pricing page and customized to the individual company.

Non cumulative pricing

Some SaaS companies operating usage-based pricing are also moving towards a use-it-or-lose-it model.

What do we mean by this?

Well, where a vendor may have previously enabled customers to collect cumulative credits and essentially adapt their usage over the course of their contract – drawing down on an agreed sum over a set period of time – they are now moving towards a fixed monthly usage model.

By losing this flexibility, many organizations will be getting far less value over time. This will almost certainly be the case for those whose usage requirements fluctuate monthly – for example online retailers – leaving them faced with hefty overage charges in busy months, or needing to commit to a more expensive subscription tier they won’t benefit from year round.

Reduced discounting

Perhaps the most subtle – if not invisible – example of software shrinkflation is reduced discounting.

This is because salespeople now have far less flexibility to reduce the price than they once did. In other words, you’re no longer able to secure quite as generous discounts on the tools within your SaaS stack.

This ultimately means that net prices are generally higher than they once were, even for the 27% of vendors that haven’t changed their pricing in the past year.

But that doesn’t mean that discounts are off the table. With the right leverage and negotiation strategy, it’s still possible to obtain more favorable rates.

How to tackle SaaS shrinkflation head on with Vertice

Shrinkflation may well be rampant across the software industry, but there are certainly steps you can take to mitigate the impact it’s having on your annual SaaS spend.

Understanding the subtle ways these vendors are raising their prices and using this knowledge to your advantage is just the first step.

To ultimately secure the best possible price, you need leverage. More specifically, you need intel into what other companies like yours are realistically paying for their subscriptions.

With access to the pricing and discounting data for more than 16,000 global software providers, Vertice makes this possible.

See for yourself how much you could be saving on your annual software spend, or alternatively read how Vertice saved one customer $170,000 on a single contract.

.webp)

![The Best SaaS Management Platforms for 2026 [According to Analyst Research]](https://cdn.prod.website-files.com/6640cd28f51f13175e577c05/687f56f6e55f8c0078341eb6_2025-06-Lionfish-Tech-Advisors-Report-01-1080x1080.webp)

.webp)