.webp)

SaaS inflation always outpaces consumer inflation

Spend on software is on track to increase by 15.2% in 2026, according to Gartner, on top of an astronomical 19.2% growth the previous year.

However it can be hard to distinguish between how much of that is genuine growth - i.e. buying more tools and paying for more users - versus artificial expansion, such as SaaS vendors raising their prices.

This research examines how - and why - SaaS spend is changing, with particular regard to inflation and rising prices.

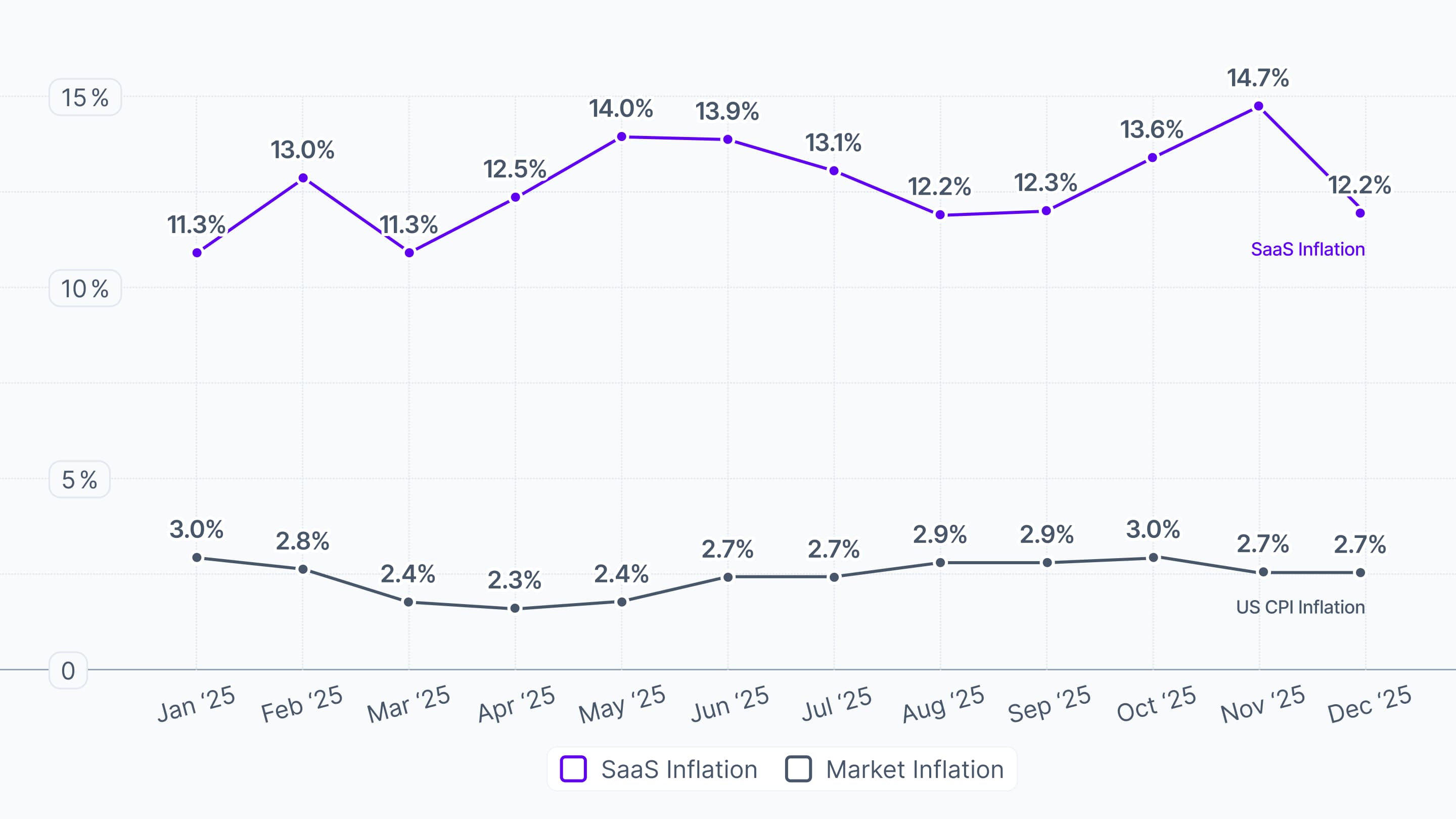

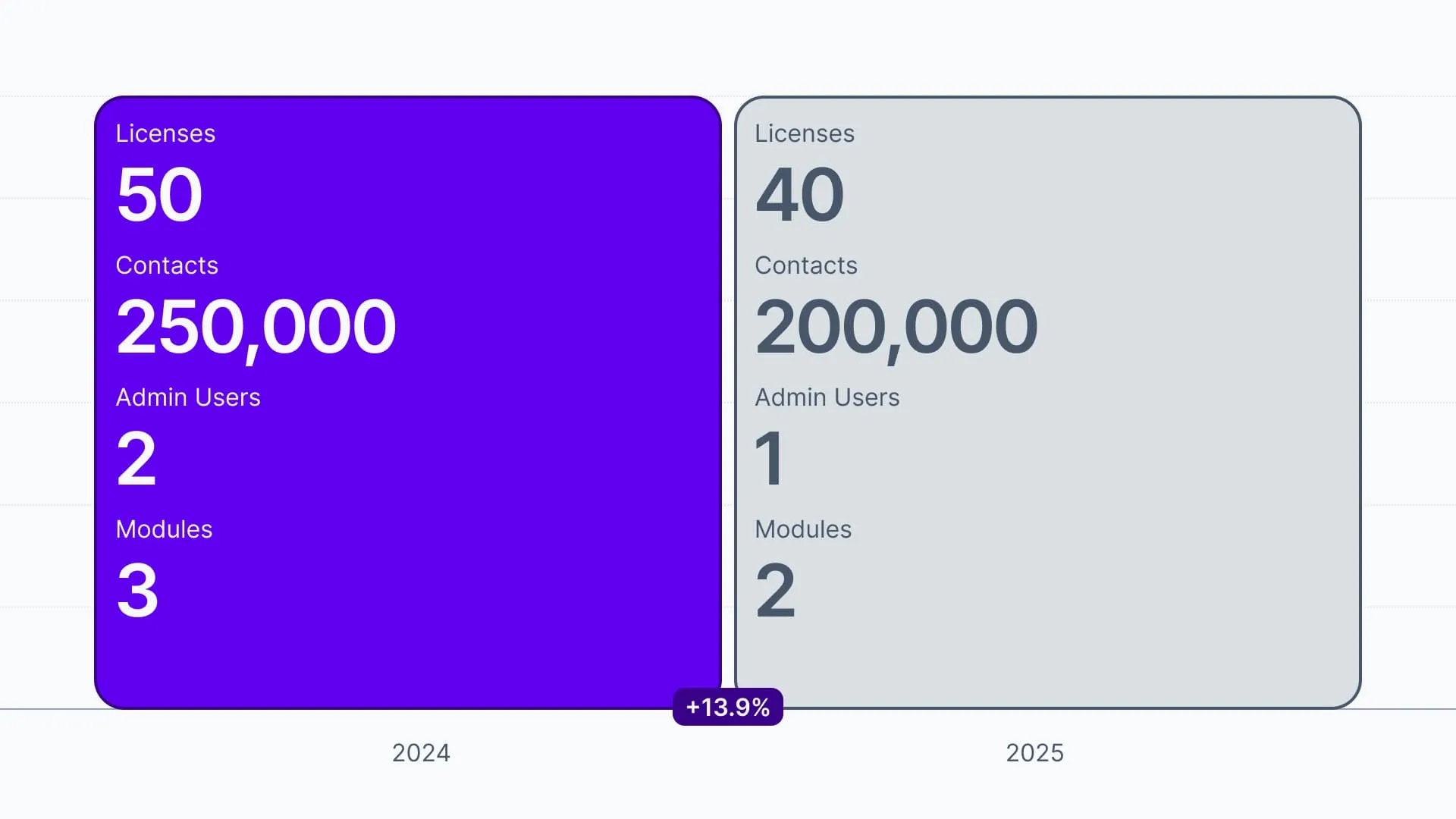

The SaaS inflation rate

SaaS inflation is, and has been for the past few years, a real problem for budget control and efficient expenditure - never dropping below increases of 10% YoY.

Market inflation, which includes everything from apparel and food to housing and utilities, has decreased drastically since a spike in 2021-2022, with the US economy now hovering just below 3%. The current SaaS inflation rate is over 4x that.

The SaaS inflation phenomena is adding uncomfortable amounts to software purchases with seemingly little direct cause.

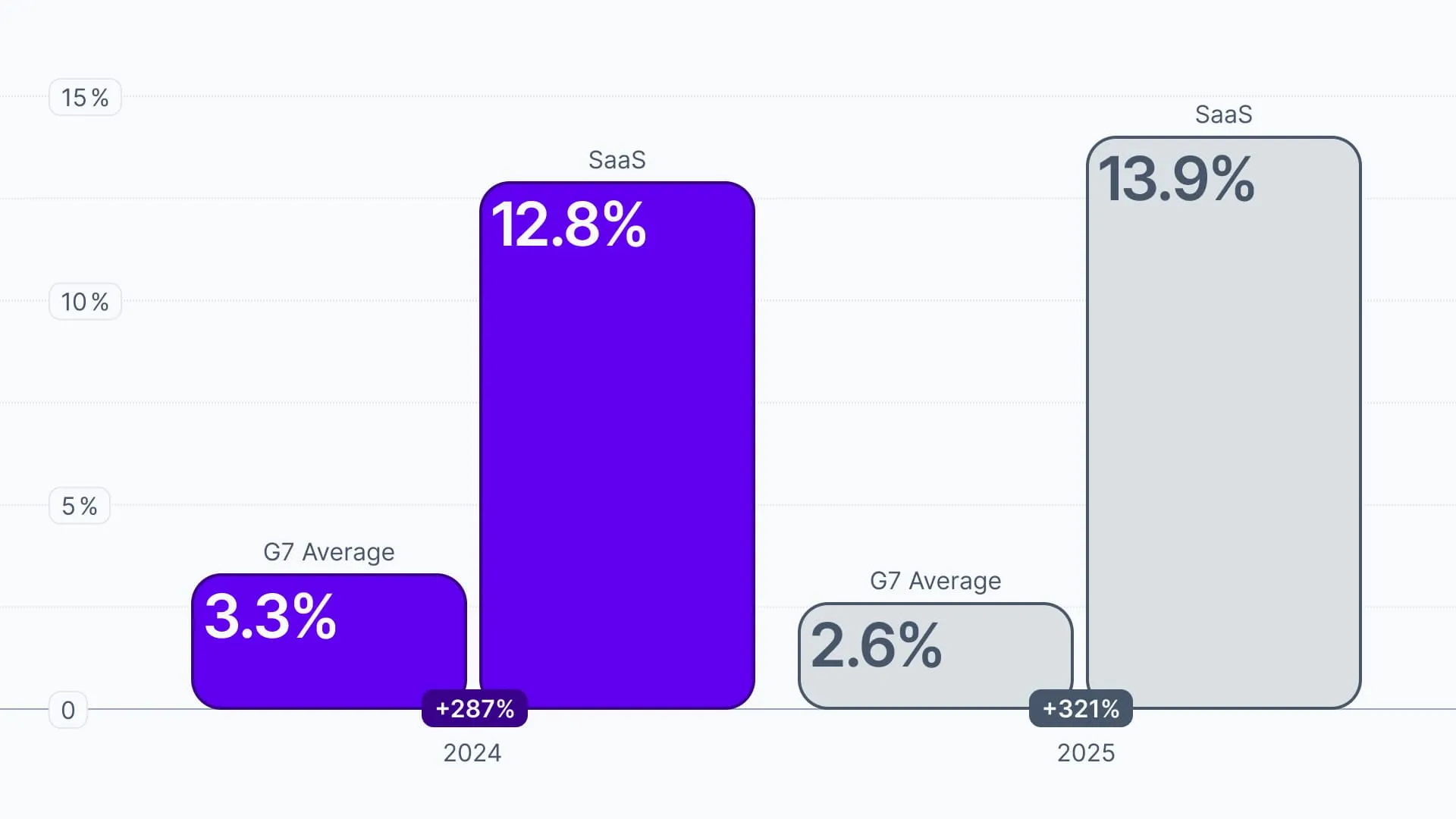

And what's more galling is this isn't an issue confined to one economy - it's a global issue, meaning businesses can't hide from it.

The graph below shows just how much higher SaaS inflation has been compared to the market inflation for the G7 group of advanced world economies over the past two years.

At the start of 2026, using the world's most advanced economies as a yardstick, we can see SaaS inflation is an astronomical 321% higher - giving businesses a real headache when budgeting and rationalizing SaaS spend.

And while SaaS inflation is less beholden to forces that dictate general consumer inflation, its global reach means it outstrips the cost of consumer goods at a swifter pace in some regions than others.

.webp)

So what's causing this? And how can businesses combat it?

It's a potent mixture of increasing software spend, vendor pricing tactics and inefficient software procurement.

SaaS spend is surging - by every measure

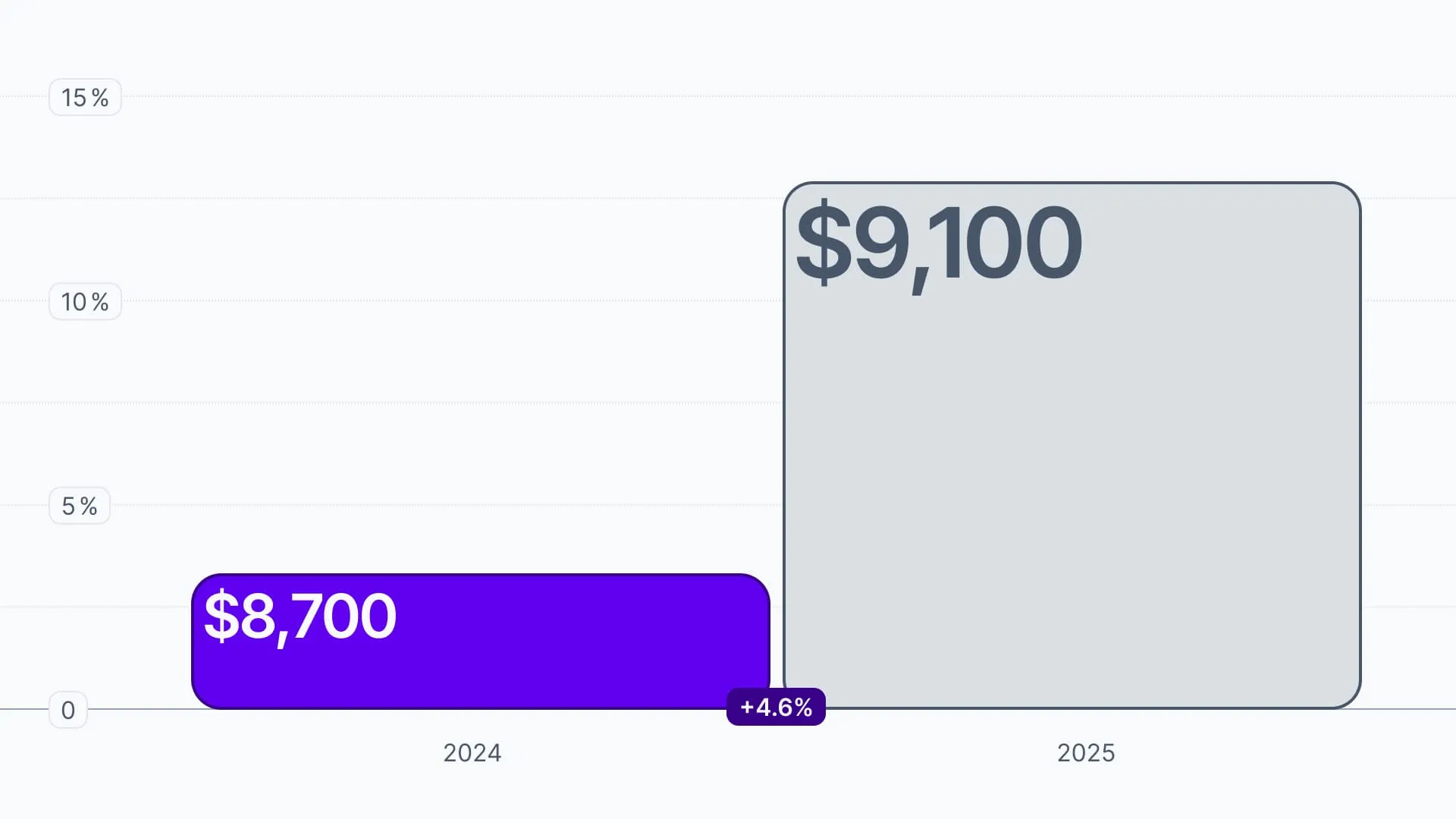

The number of SaaS apps per business hit record levels - 135.

Broken down, this represents an approximate average SaaS spend of $9,100 per employee, up from $8,700 in 2024 and $7,900 in 2023.

However it's too simplistic to put this increase - up by 31% in only two years - to just an increase in tools purchased by companies.

Over half (58%) of all software vendors put prices up over the past 6 months. And compared to the 2024 average, we are starting to see a worrying trend increase after a welcome backslide.

This is driven by significant price hikes from popular vendors, such as Snowflake (31%), Monday (29%) and 1Password (28%).

The rise in SaaS prices is not uniform by product category either. Productivity platforms (such as Microsoft and Google) and Marketing tools (such as Braze and Amplitude) have seen the biggest category-level price hikes - 22.9% and 18.1% respectively.

This is compounded by both of these categories taking up 17.7% of a typical enterprise company's SaaS budget. Businesses therefore need to be even smarter about the SaaS they source to prevent costs getting out of control.

And vendors are also changing how they charge for their products and services.

.webp)

Changes to pricing structures do not inherently cause prices to skyrocket - though they can do if left unchecked or agreed to without proper research.

They mostly impact when widespread headcount cuts combine with inflexible SaaS contracts that won't accommodate fewer users.

Reductions in headcount mean the SaaS cost is spread over fewer employees as many vendors charge by usage, volume, consumption or features - as opposed to per user.

And those who do charge per user (39%) are very unlikely to offer meaningful discounts outside renewal times, or without restarting a contract term - an unattractive offer for a business making headcount cuts.

Increases aren't the only issue though

All of these adjustments - meant to squeeze budgets by inflating prices, isn't the only contributor to a rising SaaS inflation rate. There is another, more hidden, practice that keeps prices high.

SaaS Shrinkflation is rampant

Inflation is typically a fairly intuitive concept. It’s relatively simple to grasp why a grocery item that cost $1 five years ago now costs $2.

But SaaS is a little more nebulous. The reasons involve a complex and frequently changing constellation of packages, bundles, license agreements and pricing structures.

The complexity often leads to 'Shrinkflation' - a portmanteau to describe obfuscated reductions in value for the same or greater price - which has appeared in 27% of SaaS vendors contracts in 2025... so far.

The problem is a lack of clarity and visibility regarding prices, offers and contract terms. Only 39% of SaaS vendors publish their pricing publicly, such as on their website.

This is important because, according to our research, vendors that aren't forthcoming with 'Pricing Clarity' are much more likely to increase prices than those who are.

So we developed the 'Pricing Clarity' rating to help businesses. It's comprised of three core metrics concerning SaaS vendors' pricing:

- Simplicity: how easy and intuitive pricing is to understand

- Transparency: the availability of published pricing structures

- Parity: the consistency of pricing across similar customer profiles

Vertice research shows that an increase in Pricing Clarity by one standard deviation leads to lower average price increases by 2.7%.

Put simply, the more hidden, complicated and divergent a vendor’s pricing is, the more likely it is to have recently been increased.

Some common tactics among SaaS vendors, which can be important to understand when entering into purchase or renewal negotiations:

- Bundling of products and features can often hide decreases in real value to end customers. Vendors often position their pricing to compile multiple solutions into a single offering, not all of which are necessarily required by their customers.

- Equally, unbundling of products and features can achieve the same end result. Some SaaS vendors will start to charge for individual modules rather than a single platform, enabling them to squeeze out more revenue per customer.

- Non-cumulative pricing limits the amount of value a customer can accrue. Discounts and benefits will apply only in bands - for example rather than offering a simple discount on the overall per user price for more users, discounts are only applied in steps: the first 10 users will be at rate card prices, and then user licences 11-20 are discounted, and users 21+ are discounted further. Such a structure gives the impression of reduced prices, but actually protects revenue for the vendor.

- Currency harmonization is the practice of adjusting prices regionally to account for currency drift, retaining some parity between pricing in different markets. In reality however, vendors will increase pricing in markets where they spot a greater willingness to spend more, or less tendency to demand discounts.

- Restructuring pricing often occurs in tandem with a major product shift or launch. Vendors may use these wholesale adjustments to pricing models to mask increases as it becomes near-impossible for customers to compare before-versus-after.

- Reduced discounting is when vendors reduce the discount levels or that sales teams are authorized to grant or adjust the scenarios in which discounts may apply, and is an often invisible element of shrinkflation.

How to tackle SaaS inflation and 'Shrinkflation'

While consumers face a cost of living crisis across much of the world, businesses are facing their own ‘cost of software’ crisis, with costs rising much faster than may be considered reasonable. This is driven largely by overall SaaS Inflation, and amplified further by the more subtle impact of SaaS Shrinkflation.

But these two dynamics can only be combatted if they are understood.

This is where Vertice comes in.

Vertice is the intelligent procurement platform built for the modern enterprise. Our agentic workflows, AI insights, and market intelligence empower global businesses across 30+ countries to buy smarter and scale faster.

The Vertice platform combines total spend visibility, workflows, vendor management, contract management and expert negotiation services with the largest global dataset of pricing benchmarks and intel - covering more than 16,000 vendors and over half a million price points.

In the software category alone, Vertice processes over $10 billion in spend and has a track record of delivering 20% savings and halving procurement cycles.

Chat with our team of experts today to discover how you can combat the effects of SaaS inflation.

See how simple procurement can be

Let us show you how to halve your procurement cycles and cut costs by 20%.