Cloud spend insights for September 2023

Take a self-guided tour of the platform.

See why Vertice is trusted by top procurement leaders.

While the rising cost of software is becoming unsustainable for many organizations, it’s not the only cost that’s cause for concern.As companies continue to migrate their data off-premise, cloud computing has fast become another notable expense.And it’s one that’s growing at a substantial rate – data from Gartner indicates that while SaaS remains the largest segment of the cloud market by end-user spending, it is in fact cloud infrastructure services that are seeing the highest spending growth.The problem is, the vast majority of companies are spending way more than they need to be in this area. Often, millions of dollars more. This is despite the fact that cloud computing is meant to enable greater cost control.In our first ever edition of Cloud Spend Insights, we’ve not only explained why this is, but we’ve also provided some guidance on how you can minimize cloud costs and get more from your budget.Here’s everything you need to know.,

Insights of the month

,

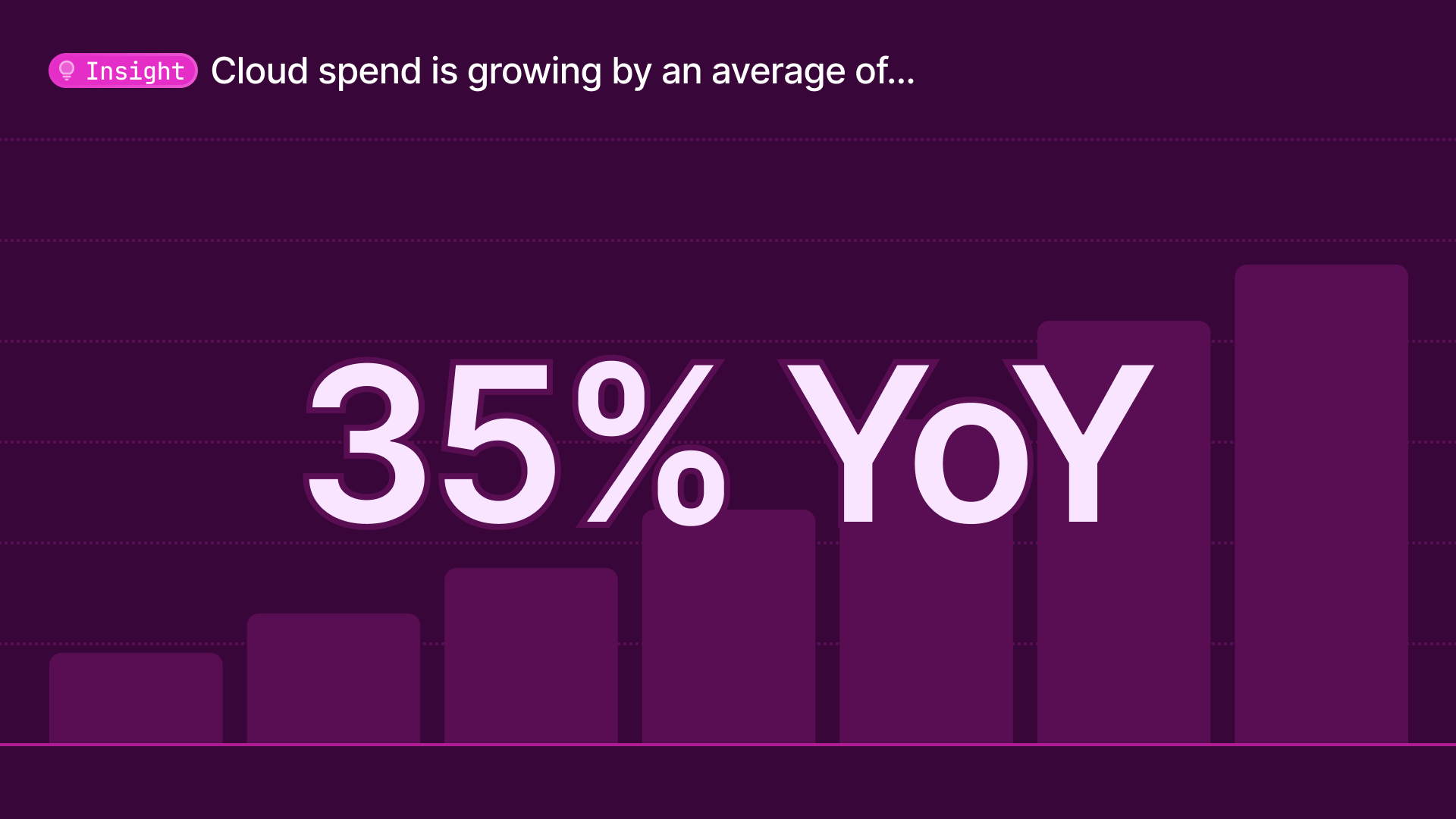

Cloud spend is growing by an average of 35% YoY

,

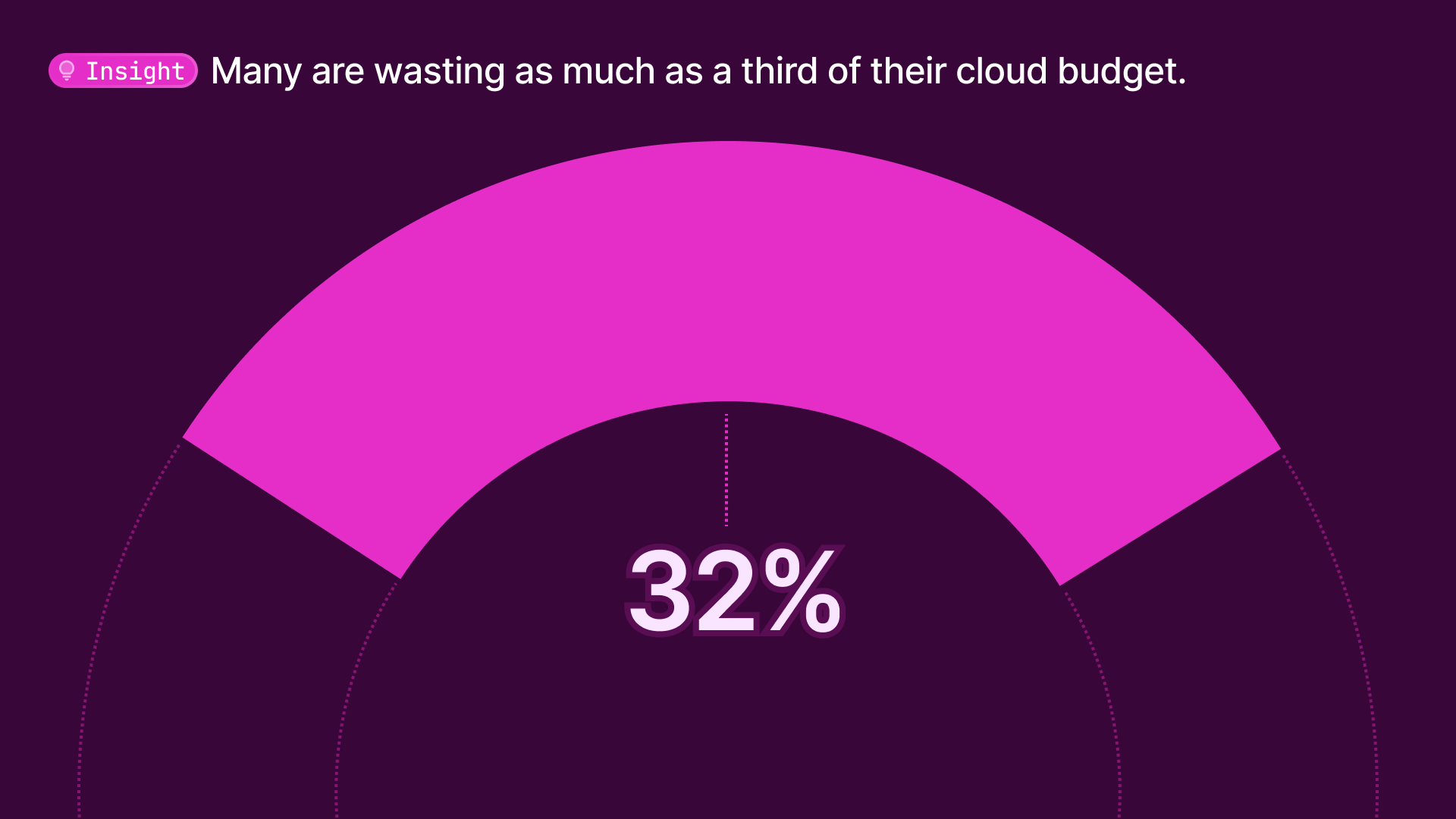

, Not only is cloud spending a significant outlay in many modern organizations, it’s also a cost that’s rising by an average of 35% year-on-year – a significant amount when you consider that many are spending millions of dollars on it each year.But while this is the average, we have seen large variations in spending across different companies, with some seeing their cloud costs increase by as much as 260% in a single year, and others by a staggering 500%.So, what exactly is driving this increase?For the most part, compute, machine learning and storage services.The good news is that despite being largely responsible for soaring cloud fees, services such as compute and storage are among the easiest to optimize. This is because most cloud providers not only bill you based on your actual resource usage, but they also enable you to rightsize instances and scale resources dynamically so that you are only paying for what you actually need.The problem is, without a cloud cost optimization platform in place, many finance leaders have very little visibility into the cloud products and services they’re actually using and how much they’re spending. Subsequently, many are wasting as much as a third (32%) of their cloud budget.,

,

More than half of all organizations are spending at least 20% more on cloud computing than forecasted

,

, It’s not just the amount that’s being spent on cloud computing that’s an issue, it’s also the volatility of this spend.Our data indicates that 53% of organizations are spending at least 20% more than expected compared to their previous month's cloud bill, with categories such as compute, databases, and networking & content delivery among the most volatile when it comes to costs. This supports data from Flexera, which found that the actual amount being spent on cloud typically exceeds budgets by an average of 18% – up from 13% the previous year.For many, this could mean the difference of hundreds of thousands of dollars every single month, posing a huge challenge for finance leaders, particularly when it comes to accurately forecasting and allocating budgetary resources.In fact, 19% of finance leaders cited the difficulty to accurately forecast spend as one of their top cloud-related challenges.Fortunately, a cloud cost optimization platform can help tackle this challenge, by not only giving you historical context on your usage, but also by providing year-over-year growth projections, enabling you to prepare budgets and cash flow models with greater predictability.What’s more, it also allows you to take advantage of the variable cost model of the cloud, for example by rightsizing, scheduling and benefiting from spot usage.,

Cloud spotlight: AWS

,

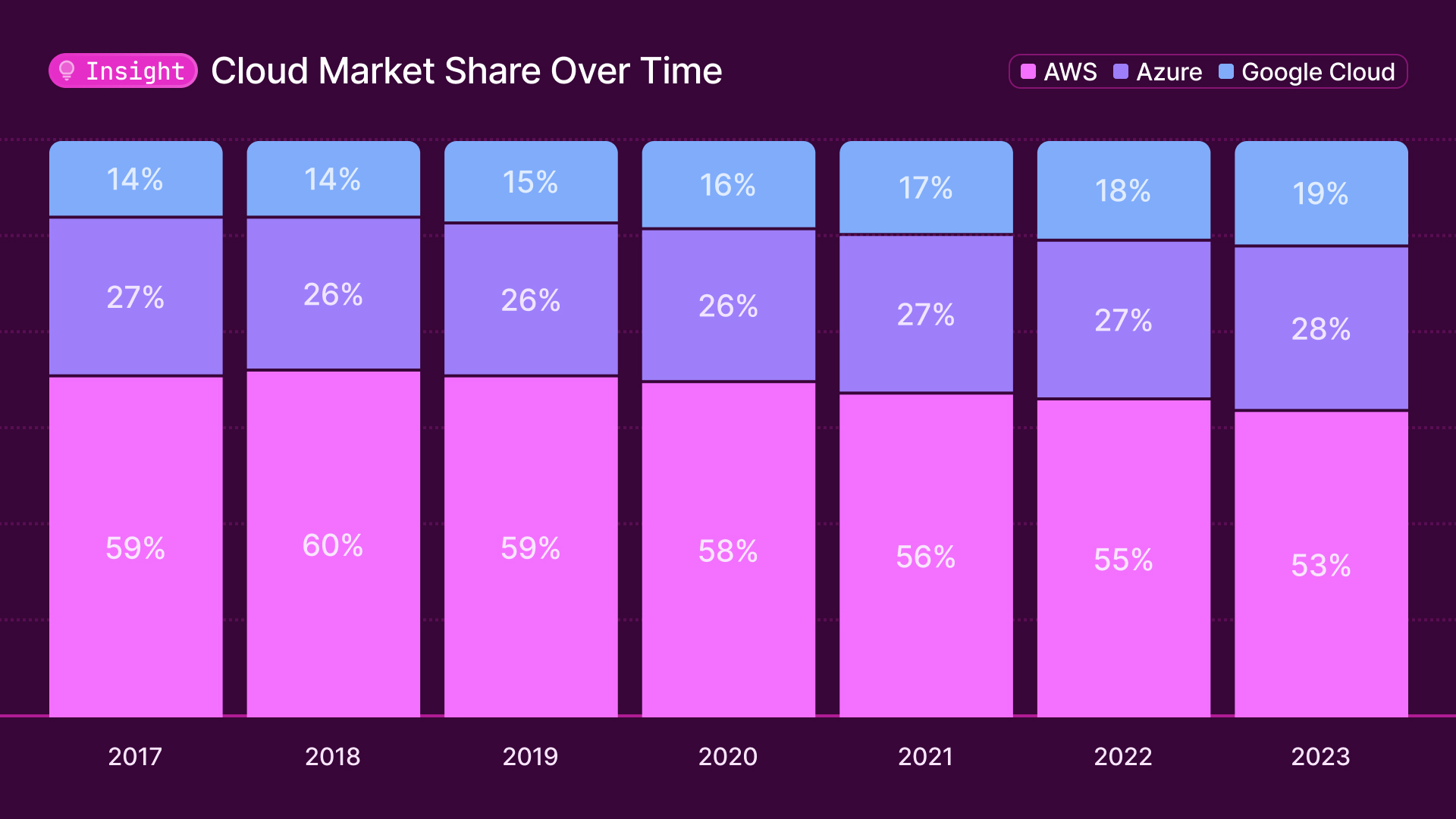

, While AWS remains the dominant global cloud provider by far, recent statistics indicate that its market share is gradually declining year-over-year, while Microsoft Azure and Google Cloud Platform’s are steadily increasing.Currently, AWS’ market share stands at 52.9%, down from 55.2% the previous year and as much as 60.1% back in 2018.,

, It’s not just AWS’ market share that is declining though, but also its year-on-year revenue growth rate. In Q1 of 2023, revenue was only up 16% on the previous year, compared to the 37% revenue jump that was reported at the end of Q1, 2022.And with 89% of organizations having either already implemented a cloud cost management strategy, or planning to in the near future, it’s likely that AWS’ growth rates will continue to slow down in the coming years.What doesn’t help AWS is that more than half of its revenue comes from EC2 – its most basic compute offering – which is one of the easiest costs to optimize. This is far more than Azure, which has a higher percentage of server revenue, and Google Cloud Platform, which has a higher percentage of data and AI revenue.,

Take control of your cloud spending

The rate at which cloud costs are rising is not only unsustainable for many organizations, but with limited visibility into cloud usage and spend, finance leaders often have no effective way to get these costs under control.At Vertice, we’re on a mission to change this.Next week, we will be launching our biggest project to date. In fact, we think it will set CFOs on cloud nine, so stay tuned for the announcement 👀☁️, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , ,

.webp)

.webp)

.webp)